High Stakes, Hidden Risks: The Price of Hype Is Centralization In Memecoins

Memecoins are the hottest pancakes this season, with a market cap hitting $59 billion — up 3600% in just a year, according to CoinMarketCap.

They're highly rewarding, grabbing attention through viral trends and social media hype.

But beyond the excitement lie risks that many new investors don’t see. Major among them is centralization, where a handful of wallets control large amounts of tokens.

This level of concentration can lead to price manipulation, sudden liquidity drops, or even project abandonment—often at the expense of smaller retail investors.

Recognizing these risks, exchanges like Bitget are raising token listing standards, requiring legal and technical reviews to filter out high-risk projects.

Similarly, Binance’s Co-founder, Yi He, emphasized in a recent tweet that no token is listed without passing an extensive screening process, highlighting the growing need for transparency in the market.

In this article, we’ll examine how centralization can turn tokens into extremely high-risk investments, with real-world case studies showing what can go wrong — and what to avoid.

In January 2024, the launch of Pump.fun made it easier than ever to create a memecoin. With a 30-second, zero-cost setup, anyone could launch a token — and in less than a year, Pump.fun has:

- Flooded the market with over 2.86 million tokens, launching 27,661 new tokens in the past 24 hours alone.

- Raked in $167.7 million in fees and revenue from token creators.

- Generated a trading volume of $1.87 billion in the last 14 days, with $131.78 million today as of writing.

And looking at the growing user data and market interest, this trend doesn’t look like it’ll slow down any time soon.

But here’s the catch — out of the 27,661 tokens launched today, only 396 hit the graduation mark. That’s a success rate of just 1.4%.

For those new to the term, “graduation” refers to tokens exceeding a market cap of $69,000 where $12,000 in liquidity are deposited into Raydium and destroyed.

With such a high volume of tokens and low success rate, many projects simply take the easy route and manipulate prices using insiders wallets.

This leads to sudden price drops or complete abandonment, leaving retail investors holding the bag.

Signs of Early Red Flags and Centralized Control

- Some tokens have over 60% of their supply concentrated in just a few wallets, giving insiders full control over price and liquidity.

- KOLs often hold large stakes in the tokens they promote, lending perceived legitimacy while influencing the price.

- Excess inter-wallet transactions. While standard blockchain explorers can track this, it falls short in showing wallet connections or token concentration visually, limiting visibility.

7 Key Risks of Centralization in Memecoins

When just a few wallets hold the majority of a memecoin’s supply, it creates hidden risks that often go unnoticed until it’s too late.

Below are seven key risks that centralized control brings with some recent real examples.

Pump and Dump Schemes

Centralized ownership allows insiders to easily pump up a token’s price and dump it at a peak, leaving retail investors with huge losses. The @IDOsolme project is a striking example of this in action.

Since August 2023, the IDOSol team has launched new tokens daily, repeating the same pattern each time:

- Each token's supply is initially spread across roughly 150 addresses, with the team controlling around 60%.

- Within 24 hours of each launch, insiders execute a coordinated dump, rapidly selling off their holdings and draining liquidity.

- After each dump, the team deletes their Twitter account to avoid accountability.

An analysis of the top traders on Dexscreener shows repeated high earnings from these operations, making it clear that these tokens were designed to profit insiders at the expense of retail investors from the very start.

Similarly, $NEIRO followed a similar but more sophisticated and structured pump-and-dump approach.

At launch, insiders coordinated a network of 80 wallets to snipe 77.7% of the supply and carefully spread the tokens over 400 addresses, each rarely selling more than $3,000 at a time.

Despite this appearance, insiders eventually extracted $4.5 million in profits.

Whale Manipulation

When large holders, or “whales,” control a significant portion of a token's supply, they can manipulate prices through bulk trades, creating volatility that retail investors can’t predict or withstand.

$DJT saw a single cluster holding 67% of the token’s supply — 46% of the supply is held by one person or group, with AxJcErA5 sending $DJT to 140 wallets.

This cluster distributed tokens across 140 wallets to create the illusion of strong trading activity and high demand. When the real demand emerged, prices dropped and retail investors were left holding the bags.

Another example will be $CATE, where the deployer’s wallet held 30% of the total supply and openly dumped $500,000 worth of tokens.

Although this was more of a rug pull than a whale movement.

Rug Pulls and Developer Abandonment

Rug pulls and sudden developer exits are two of the most damaging risks for retail investors, as insiders can quickly drain liquidity, leaving tokens worthless.

The $GINNAN project is a prime example of this.

Four primary wallets sniped 80% of the token’s supply at launch. To create an illusion, these wallets distributed holdings across 280+ addresses.

Insiders gradually sold off $2.5 million in tokens while still holding 65% of the total supply.

With control over $800,000 in liquidity, they could exit at any time, leaving the remaining investors with literally nothing. Interestingly, the same KOLs who promoted $NEIRO were also pushing $GINNAN.

Pro Tip: If you see influencers giving you trading tips or shilling tokens, take the nearest exit.

Celebrity and Influencer-Driven Risks

If there’s anything worse than influencers shilling tokens, it’s celebrities shilling tokens.

Celebrity endorsements often give tokens a short-lived boost in visibility and value, but when these promoters hold large stakes, retail investors usually end up bearing the brunt.

$WAP, a token promoted by Cardi B, the American rapper and songwriter, stands as a textbook example of a no-utility, celebrity-hype token.

Right from launch, 60% of the token supply was bundled in a cluster of wallets, which attempted to mask their bundling activities by transferring tokens to new addresses.

These 15 addresses were used to snipe and form clusters visible on the bubble map, all funded by a single CEX address, 7FfB2z.

Within hours, this cluster transferred $WAP tokens to nearly 100 addresses, simulating trading activity to create an illusion of demand. Eventually, insiders dumped $500,000 worth of tokens.

Wash Trading and Artificial Volume

Wash trading involves coordinated trades between controlled wallets to artificially inflate trading volume, misleading investors about a token’s popularity and demand.

$MCDULL project, promoted by former Brazilian footballer Ronaldinho, is a great example of what kind of tokens should be avoided. From the start, 100% of the token supply was sniped by insiders.

Since they had all the supply, they could manipulate the numbers as much as they wanted using controlled wallets to create the illusion of high trading activity and strong market interest.

Governance Manipulation

In projects where tokens grant voting rights, centralized ownership allows a few wallets to control key decisions, often prioritizing insider interests over the community’s.

A close classic case is $BALL, where the developer’s wallet was part of a cluster that controlled 67% of the tokens, effectively giving the developer total control over decision-making.

Later, the developer dumped $330,000 in a single transaction — without even trying to hide it.

Lack of Transparency

A lack of transparency around token ownership and wallet activity increases the risk of sudden sell-offs and liquidity drains.

Coffeezilla, a well-known investigative YouTuber, recently exposed Andrew Tate’s shift from anti-crypto until a few years ago to openly promoting tokens like $GER, $FUCK MADONNA and $TOPG without disclosing holding details.

- $GER: Tate started with $GER with a single cluster holding 30% of the supply, and after Tate’s endorsement, the price briefly surged before crashing 99% within two months as insiders exited.

- $FKMADONNA: Tate shared this token along with his public wallet address, driving $2 million in volume within minutes, but the token fell to zero within 24 hours.

- $FTRISTAN: Prompted by Tate’s “Fuck Tristan” tweet, the token generated $15 million in volume before fading to zero shortly after.

- $TOPG: Tate acquired 58% of the supply and tweeted about it multiple times, fueling massive attention. Trading volume reached $300 million before a sharp drop as the hype cooled.

Andrew Tate also promoted $ROOST, $RNT, and $DADDY. Following Tate’s endorsement, each token’s price spiked briefly before plummeting sharply.

Centralization Beyond Memecoins — Stablecoins, Staking, and DEXs

While centralization is much higher in memecoins, the risk has extended far beyond to core areas in the crypto like stablecoins, staking pools, and decentralized exchanges (DEXs).

These areas form the backbone of DeFi, but high concentration in control can introduce vulnerabilities and undermine decentralization.

Stablecoins

Stablecoins, which play a foundational role in DeFi by providing liquidity and stability, are largely controlled by two issuers — USDT (Tether) and USDC (Circle).

As per CoinMarketCap on the day of writing, these two stablecoins hold approximately 89% of the stablecoin market cap, totaling around $155.2 billion in value. Tether alone accounts for about 78% of this, while Circle manages roughly 22%.

Key risks include:

- Liquidity Shock: If either issuer faces a liquidity crisis, regulatory action, or other disruption, nearly 90% of DeFi’s stablecoin liquidity could be at risk, potentially leading to widespread protocol failures.

- Opaque Reserves: Concerns over Tether’s reserve transparency heighten the risk. Any negative revelations could destabilize DeFi protocols reliant on USDT, underscoring the vulnerability of depending on a centralized entity.

Staking Pools

Following Ethereum’s shift to Proof-of-Stake (PoS), staking pools have become critical to network security.

However, these pools are increasingly centralized. As of the time of writing, Lido manages approximately $24.528 billion in Total Value Locked (TVL), while Binance staked ETH accounts for about $3.944 billion in TVL.

Key risks include:

- Governance Influence: With such substantial shares, large pools like Lido and Binance have the potential to sway governance decisions, influencing Ethereum’s future direction and potentially undermining the influence of smaller stakeholders.

- 51% Attack Potential: Concentrated staking power raises security concerns. Should a few large entities coordinate, they could theoretically control the network’s consensus, posing a risk of a 51% attack that could compromise Ethereum’s decentralized foundation.

Decentralized Exchanges (DEXs)

Ironically, some of the largest DEXs show centralization in their governance structures.

Uniswap, which processes a substantial portion of decentralized trading volume, is divided across multiple versions on different networks.

For instance, Uniswap v3 on Ethereum alone handles around $853.6 million in 24-hour trading volume, capturing approximately 12.25% of the DEX market share.

Meanwhile, Uniswap v2 contributes an additional $223.6 million in daily trading volume, with a market share of 3.21%.

A significant portion of Uniswap’s governance tokens (UNI) is held by early investors like Andreessen Horowitz (a16z), who control a notable share of the total UNI token supply, influencing governance decisions.

Key risks include:

- Governance Manipulation: Large token holders, like a16z, can potentially sway governance decisions, guiding the DEX to favor major investors over the broader community like it happened during Wormhole vs. LayerZero.

- Market Capture: Centralized governance can impact token listings, trading fees, and liquidity protocols, which may restrict access for smaller projects and compromise the principles of a decentralized, community-led exchange.

These examples highlight that centralization concerns extend beyond memecoins, affecting liquidity, security, and governance across DeFi.

As the crypto ecosystem continues to grow, addressing centralization in these critical areas will be essential to preserving decentralization and stability within the DeFi landscape.

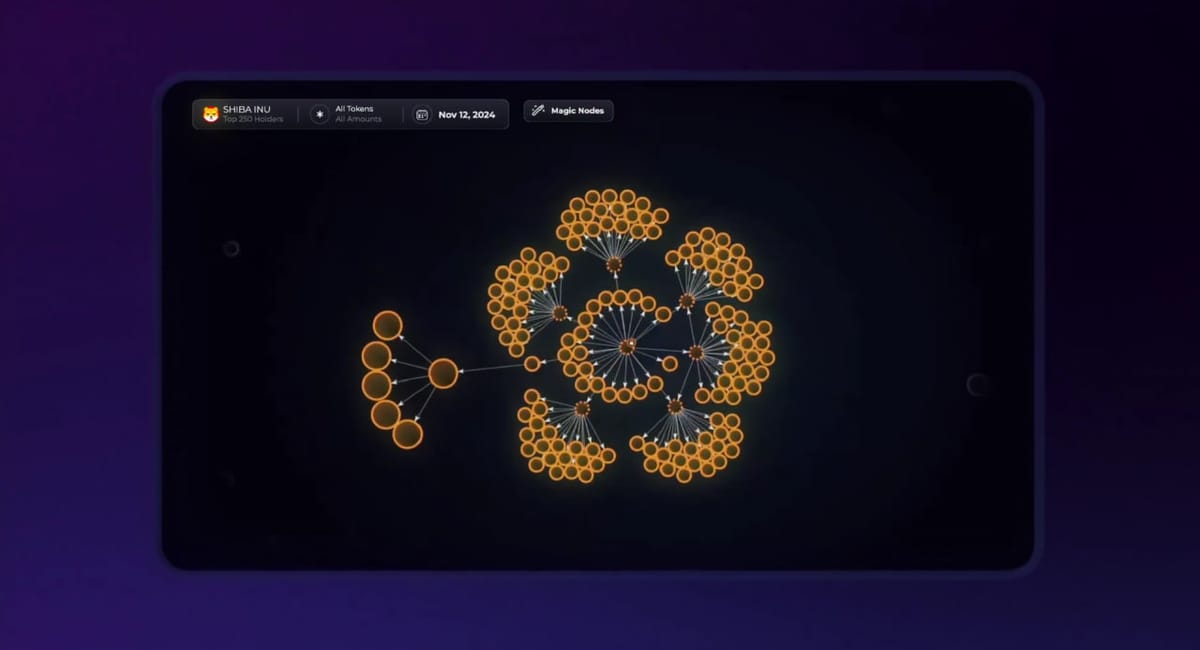

How Bubblemaps Can Help Investors Identify and Avoid Centralization Risks

Bubblemaps uses a visual approach to uncover patterns in token distribution and wallet activity across blockchains that traditional explorers miss.

Each bubble on the map represents a wallet, with size indicating holdings and color-coded connections showing token clusters. This setup allows investors to easily spot centralization risks.

With Bubblemaps, investors can:

- Visualize Token Distribution: Identify wallet clusters and assess whether a token’s ownership is centralized or distributed.

- Detect Suspicious Activity: Spot coordinated wallet actions that signal wash trading, pump-and-dump schemes, and other high-risk activities.

- Track Wallet Movements Over Time: Use Time Travel to view historical changes in token holdings and spot potential sell-offs before they affect prices.

Supporting nine major blockchains, including Ethereum, Solana, Base, BNB Chain, and Polygon, Bubblemaps integrates with popular tools and platforms like Etherscan, OpenSea, DEX Screener, GeckoTerminal, and Pump.fun.

This helps users with on-chain data and deeper insights, helping them to do extensive research, get the bigger picture with ease, and make more informed investment decisions.

A Positive Example and Model for Decentralization — $SPX6900

Not all tokens suffer from centralization issues. $SPX6900 stands out as an example of decentralized token distribution, aiming for stability and transparency from the outset.

- High Liquidity Commitment: At launch, 94% of $SPX6900’s supply was added directly to liquidity, with the remaining 6% burned, creating an open market environment that minimizes insider influence.

- Balanced Growth: By September 2023, no single cluster held more than 13.6% of $SPX6900, with most holdings coming from community contributions for platform fees. This decentralization reduces the risk of concentrated sell-offs and market manipulation.

- Responsible Influencer Engagement: Influencer @MustStopMurad holds about 3% of $SPX6900 across three wallets, providing promotional support without compromising the token’s decentralization.

Projects like $SPX6900 offer hope that not every project is out to rug investors. Some are genuinely built around community and decentralization.

Turning Transparency into a Competitive Advantage for Investors

Centralization is a major, often hidden risk in memecoins and DeFi, where large wallet holders, influencer-driven promotions, and opaque tokenomics can lead to sudden losses.

But transparency offers a way forward. With tools like Bubblemaps, investors gain a clear view of token ownership and wallet patterns, turning transparency into a powerful advantage in a competitive market.

Research from Binance highlights that when projects provide detailed disclosures of wallet activity and fund usage, they build trust and accountability — two essential elements for long-term success.

Unlike traditional blockchain explorers, Bubblemaps simplifies complex data into easy-to-read visuals, helping investors quickly assess a token's true distribution and make informed, confident decisions.

Here’s How to Get Started with Bubblemaps

- Visit Bubblemaps.io: Log in with a Web3 wallet or explore without logging in for a quick overview. (Log in with an email address if you're using V2)

- Search for a Token: Use the search bar to find any token by name, address, or symbol.

- Select the Blockchain: Choose the correct blockchain network (e.g., Ethereum, Base, etc.) to get accurate token mapping.

- Analyze Wallets: View the map of wallet clusters, and click on individual bubbles for wallet details and transaction histories.

- Detect Patterns: Use filters to identify token clustering, concentration, and flow.

- Bubblemaps highlights wallet connections and potential patterns, providing insights into token distribution and possible manipulation risks.

Written by: Uddalak Das