Exposing a16z’s Hidden Control in Uniswap’s Governance

Despite Uniswap's decentralized claim, a16z wields outsized power in governance, influencing key decisions behind the scenes.

Uniswap operates as a Decentralized Autonomous Organization (DAO). The concept is simple — $UNI token holders exercise their governance rights and make collective decisions about the protocol's future.

They can submit proposals, discuss and vote on them, and essentially decide where Uniswap is headed. However, since the governance ecosystem is driven by the $UNI token — the more you hold, the more power you have, allowing investors holding massive bags to control everything.

DAO sounds like utopia until it's not. Sure, it's democratic in theory, but far from it in practice. Despite this decentralization, the Uniswap community has seen significant influence from large institutional investors like a16z.

Governance Requirements

Let’s start from the basics. For those who are unfamiliar’, there are several safeguards to protect the community from spam proposals and forced governance takeover.

- A proposal must meet a minimum threshold of 0.25% of the total $UNI supply, translating to 2.5 million $UNI tokens.

- For a proposal to pass, it must gather a quorum of 4% of the $UNI supply — roughly 40 million $UNI tokens, ensuring that decisions are made by a large portion of the community.

- It also involves a ‘temperature check’ to see if the community likes the idea before it enters the formal voting stage.

The intent of this governance system is to maintain decentralization, encourage active participation, and give token holders a meaningful voice.

Concerns Over Centralization

Uniswap might have sold the dream of decentralization, but as with many DAOs, the reality looks different.

This brings us to what many critics, including Cobie in July 2021, call “governance theater” a.k.a the extreme case of centralized decentralization where governance power becomes concentrated and dominated by a small number of whales — early investors, VC, and large token holders.

They hold the power, while smaller token holders are left with little more than the illusion of democracy.

Governance Conflict Over BNB Chain Deployment

Fast forward to December 2021, Cobie’s words weren't just theoretical anymore. The governance conflict over Uniswap V3's deployment on the BNB Chain became a headline for the power struggle within Uniswap's DAO.

On December 11, 2021, a proposal was submitted by 0xPlasma.eth to deploy Uniswap V3 on BNB Chain, which was seen as a critical move to expand Uniswap’s user base and enhance its strategic position within the broader DeFi ecosystem — and it seemed like a no-brainer.

- Potentially capture around $1.18 billion in Total Value Locked (TVL), based on half of PancakeSwap’s $2.36 billion TVL.

- Bring 1-2 million new users and $UNI holders to the platform

And at first, the Uniswap community seemed to agree. During the initial temperature check, there was overwhelming support for deploying Uniswap V3 on BNB Chain. Celer’s cBridge was floated as the bridge of choice.

However, the focus shifted in the next stage when Eddy Lazzarin, an investing partner at a16z, took to the Uniswap Forum and conveyed that a16z’s stance, pushing for LayerZero as the top choice.

Celer’s cBridge was dropped and two names quickly rose to the top:

- Wormhole: The community-backed cross-chain bridge, favored for its technical advantages and strong track record in facilitating cross-chain asset transfers.

- LayerZero: A bridge backed by a16z, raising concerns about conflicts of interest since a16z had led a $135M investment round in LayerZero in 2022.

Suddenly, what seemed like a straightforward governance decision turned into a battle of interests.

Voting Outcome: Community vs. VCs

When the votes were tallied, Wormhole emerged victorious with 28 million $UNI votes in its favor and LayerZero with 17 million votes — 15 million from a single party, a16z. This was a huge win for the community, but it raised more questions than it answered.

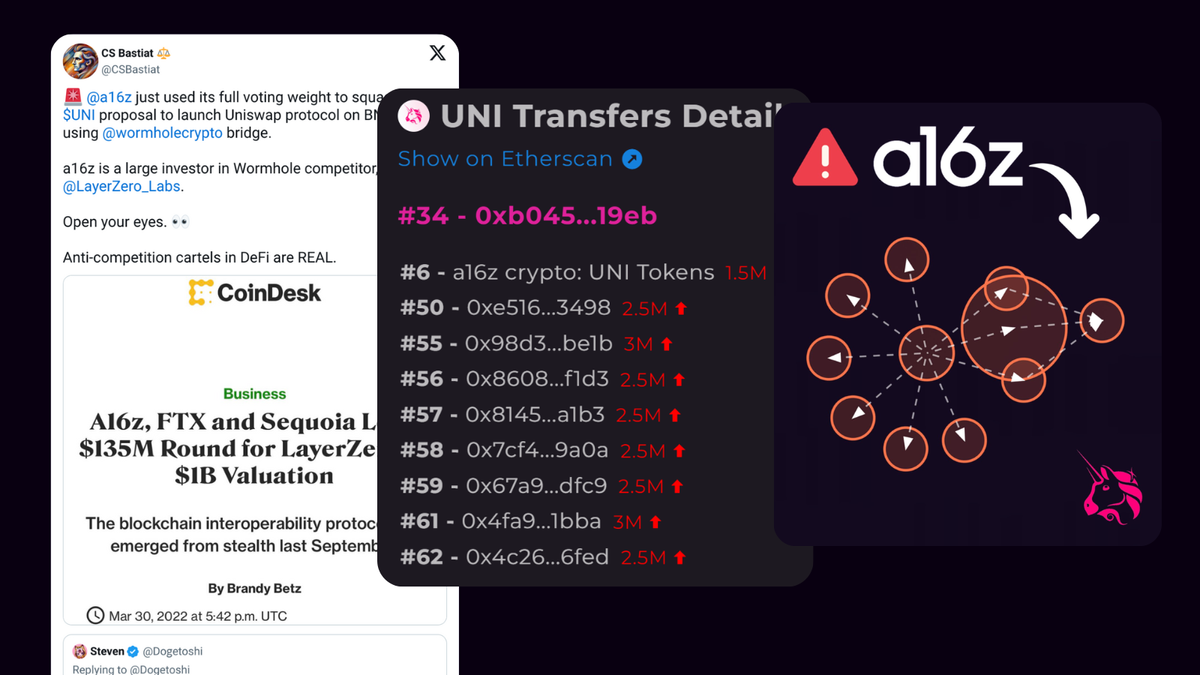

Here’s another catch: a16z used 15M $UNI to vote in favor of LayerZero, but in reality they had 3.5x more tokens — more than enough tokens to sway any community decision. How do we know?

Bubblemaps’ Key Findings and Extent of a16z’s Control

Bubblemaps is a blockchain researcher tool that visualizes wallet connections and on-chain patterns, providing a clear view of how different wallets interact within projects.

Using this, we were able to track the movement of $UNI tokens and identify how a16z’s influence was exerted across multiple wallets.

- Detected a cluster of 10 wallets receiving 2.5 million $UNI each from a central wallet, 0xb04.

- 2.5 million $UNI sent to each wallet was exactly the amount required to submit governance proposals.

- For example, 0x3c0 received 2.5 million $UNI, 1.5 million from a16z and 1 million from two wallets.

- This cluster of wallets collectively controlled 4.15% of the total $UNI supply, enough to achieve a quorum for votes independently.

By strategically using these wallets, a16z could introduce and potentially pass proposals without needing the backing of the larger community, giving them outsized control in the governance process.

In addition to our findings, if we look at the statements from Eddy Lazzarin, head of engineering at a16z, the firm actually controls approximately 55 million $UNI tokens, representing 5.5% of the total supply — higher than initial deductions.

While he didn’t deny the influence a16z wielded, he attempted to downplay it, pointing to their “delegation” strategy as proof that they weren’t actively trying to dominate governance.

According to Lazzarin, a16z had delegated around 40 million $UNI to third parties, including universities and research labs. The goal, he claimed, was to diffuse their influence and spread governance participation more widely. But there was a catch — a16z could reclaim those votes at any time.

So, while it might look like they were giving away control, the reality was that a16z could pull those tokens back whenever it suited them.

In other words, they still had the potential to consolidate even more power over governance decisions in the future.

The Road Ahead for Governance

But if Uniswap’s case is any indication, we still have a long way to go. The case of a16z’s influence over Uniswap’s governance exposed one of the biggest challenges facing DAOs today — wallet concentration.

While decentralization is the goal, large token holders, especially VCs, can still exert outsized control, undermining the very principles that DAOs are supposed to uphold.

Despite Uniswap’s governance model appearing decentralized, Bubblemaps revealed that much of the decision-making power remained concentrated among a16z-backed wallets, making the community's role more symbolic than substantive.

If there’s one takeaway from the a16z-Uniswap saga, it’s this — transparency in projects and tokenomics are more critical than ever. And that’s where tools like Bubblemaps come in.

Bubblemaps provides a visual breakdown of wallet connections, letting anyone analyze how token holders interact with a given protocol.

Here’s how you can use Bubblemaps to dig into insights for any token:

- Visit Bubblemaps.io: Log in with a Web3 wallet, or explore without logging in.

- Search for a Token: Use the search bar to find the token by name, address, or symbol.

- Select Blockchain: Choose the blockchain (e.g., Ethereum, BNB Chain) for the token.

- Analyze Wallets: View the map of the largest 150 wallets. Click bubbles to see wallet details and transaction histories.

- Detect Patterns: Look for clusters of connected wallets and use filters to focus on relevant data. Bubblemaps allows users to trace the flow of tokens between wallets, identifying patterns that suggest coordinated activity.

Written by: Uddalak Das