The battle of $NEIRO

After the family of Kabosu (aka DOGE) adopted a new dog named Neiro, influencers and insiders quickly saw a chance to profit. The resulting activity kicked off a battle on the Ethereum and Solana blockchains. While the situation on Solana is still unfolding, the outcome on Ethereum seems decided for now.

Numerous Neiro-themed tokens launched around the same time, we have covered two of them, one on Ethereum, one on Solana.

Ethereum

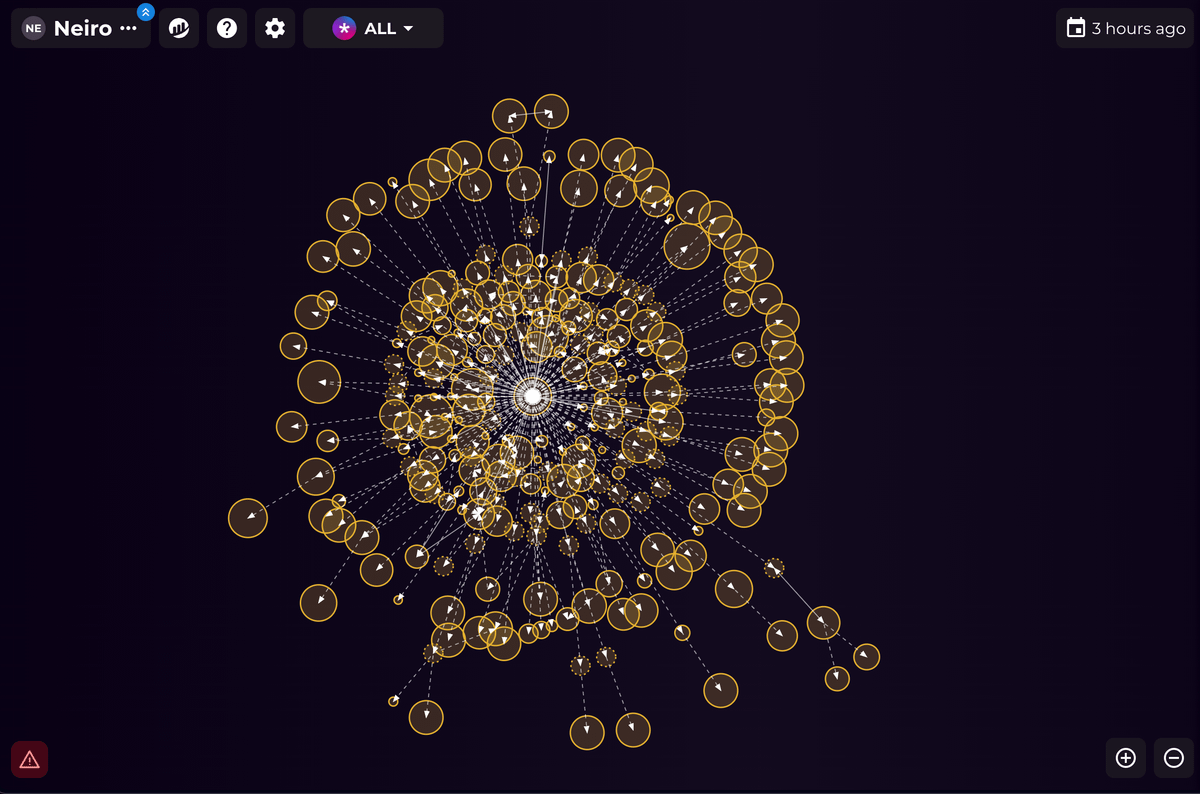

At the time of writing, the highest market cap for $Neiro was on the Ethereum blockchain. However, there's more to this than meets the eye. The launch was heavily manipulated, resulting in a tightly controlled supply.

$NEIRO on ETH (@neiro_ethereum) is heavily controlled ⚠️

— Bubblemaps (@bubblemaps) July 30, 2024

78% of the supply was sniped at launch and spread out among many wallets.

Insiders already made $4.5M and still own 66% 🧵 ↓ pic.twitter.com/dEwiuE3Gu2

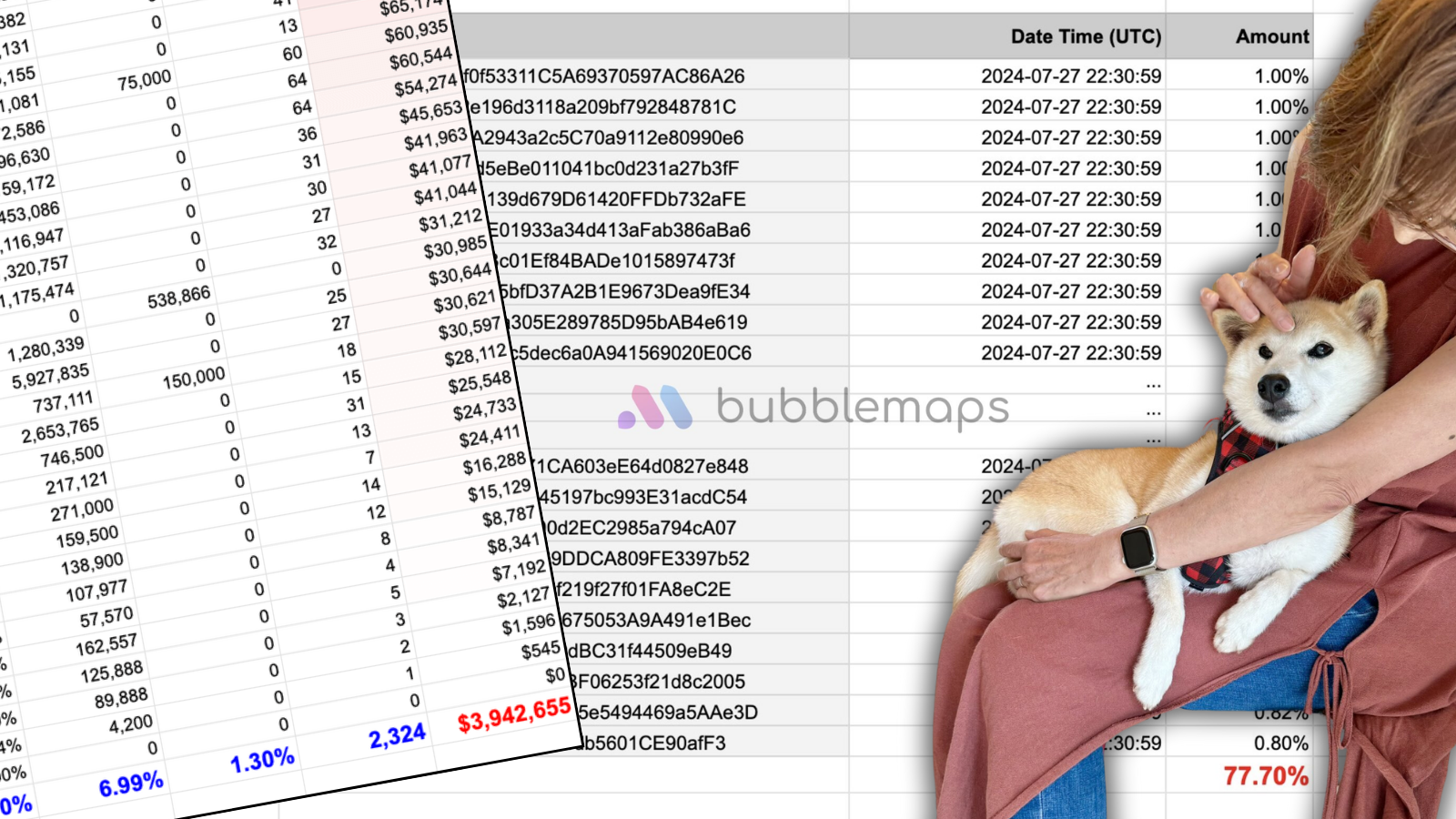

Specifically, over 78% of the supply was controlled by the team and insiders. Within the first 48 hours, they sold over $4 million worth of tokens, retaining more than 65% of the supply. Further analysis here.

The team employed a careful strategy for selling the tokens. Instead of direct sales, they spread the tokens across 400 different wallets, selling them in small increments, around $3,000 at a time.

Given the strategic efforts to conceal the concentration of supply, we conducted a deeper investigation. We analyzed over 10,000 transactions related to $Neiro. You can find the full breakdown in the following tweet: In-depth analysis

We continue to monitor the $Neiro token as the team and insiders gradually sell off their holdings. Since the launch a week ago, they have sold over $6.5 million worth of tokens.

Solana

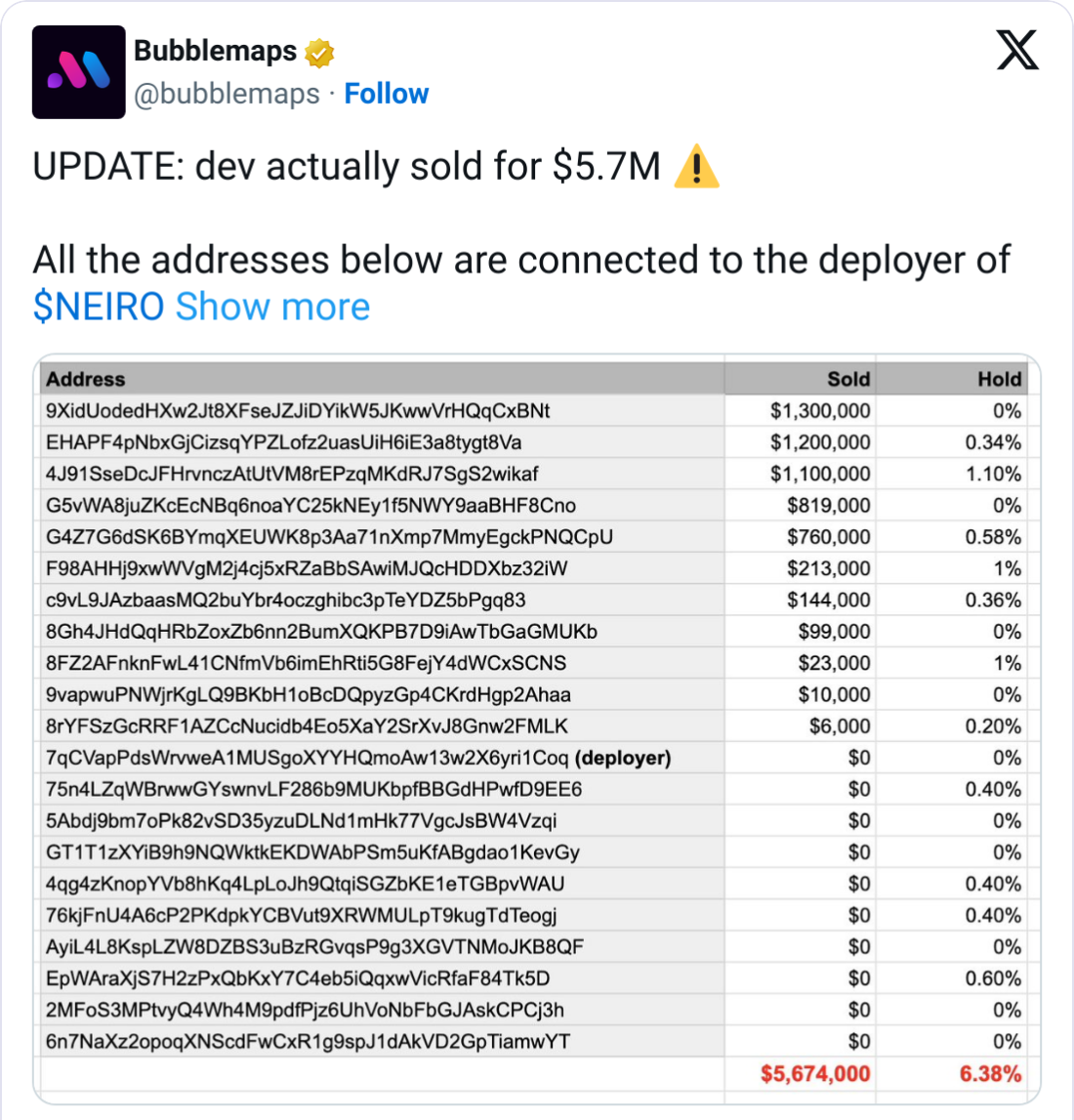

The first $Neiro token to reach a $100 million market cap was launched on the Solana blockchain. Initially, it appeared to be a pump-and-dump scheme, where the developer acquired a significant portion of the supply through multiple wallets. Within just 12 hours of the launch, the developer had profited $3.3 million and still retained over $4 million worth of tokens.

The dev of $NEIRO still holds 6% of the supply 🚨

— Bubblemaps (@bubblemaps) July 28, 2024

He bought from multiple addresses, not only 7qCVapP, and currently owns 10 huge bags of $NEIRO

• realised P&L: $3.3m

• unrealised P&L: $4m

Ansem just made him retire 👀 pic.twitter.com/qFtmBfIBMx

The developer later claimed on X that some of the wallets we investigated belonged to his friends and that he only held 1.6% of the supply. However, this statement raises serious doubts.

Additionally, one of the team members (referred to as the developer's friend) in their Telegram group claimed that all the wallets we identified publicly would eventually burn the tokens they held. Unsurprisingly, this has not yet occurred.

After compiling all the wallet addresses connected to the deployer, we discovered that the developer and his "friends" had sold more than initially estimated. Their net profits actually exceeded $5.7 million.

The insights gathered so far reveal a complex web of transactions, highlighting the importance of transparency in the crypto space.

Stay safe