How Hayden Davis Rugged $LIBRA for $100M With President Milei

It began with Donald Trump’s $TRUMP, which launched in mid-January. It quickly surged to an all-time high of $75.35, backed by $19 billion in trading volume.

Just days later, Melania Trump followed with $MELANIA, President Touadéra of the Central African Republic released $CAR and finally, Argentina’s President Javier Milei announced $LIBRA.

At first glance, these tokens looked like harmless political spin-offs. But data showed:

- Wallets linked across all three tokens.

- Sniper bots extracting early profits.

- Tightly clustered supply held by insiders.

By the time the dust settled on $LIBRA, $100M had been pulled from liquidity pools and all trails led back to Hayden Davis.

This report breaks down what happened – how the tokens were structured, who profited, and why user funds remain unreturned.

Trump and Melania Tokens Were the Warning Signs

On January 18, 2025, Donald Trump released his own memecoin — $TRUMP. It started trading at just a few cents and exploded to an all-time high of $75.35 in days, with over $19 billion in volume.

Some argue that this moment — or maybe the rise of tools like Pump.fun — marked the beginning of the presidential meme coin boom. But there’s no doubt that Trump, arguably the most powerful man in the world, opened the floodgates.

Just a day later, on January 19, Melania Trump launched her own token, $MELANIA. It closely mirrored the structure of $TRUMP — but with even fewer safeguards.

$MELANIA was seen as a blatant cash grab. At launch, 82% of the supply sat in one cluster of wallets and a presale wallet holding 10% dumped most of its allocation immediately.

This was followed by President Touadéra of the Central African Republic releasing $CAR, an 'experiment'. Then came $LIBRA, which took this model to a much larger scale.

The Rugpull That Shook a Presidency

On February 14, 2025, Argentina’s President Javier Milei publicly endorsed $LIBRA, a so-called national digital initiative aimed at boosting the local economy and supporting small businesses.

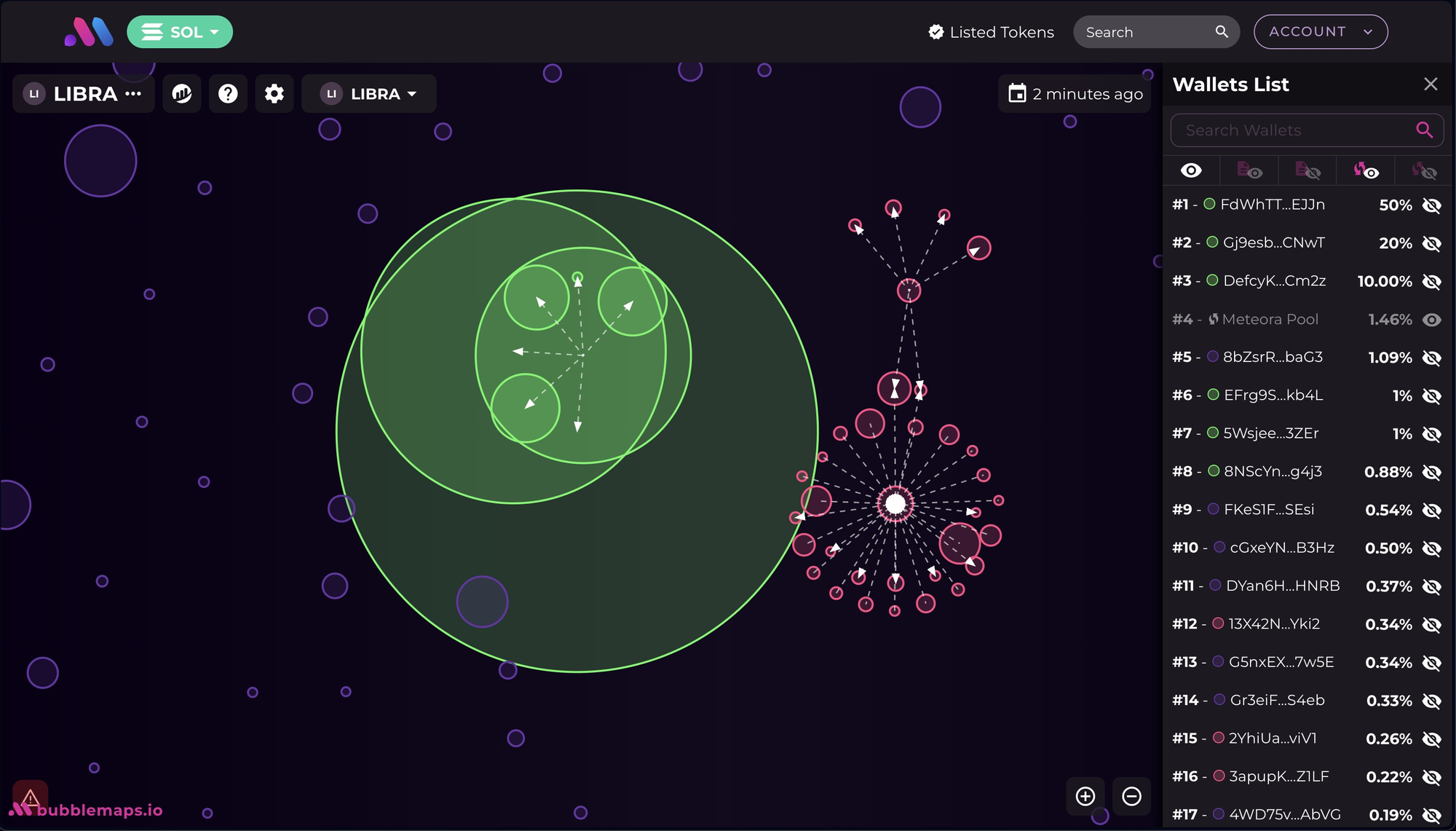

The catch was that 82% of $LIBRA was unlocked, which means they could sell anytime. Despite the risks, the token surged to a $4.5 billion market cap and liquidity pools made over $25M in fees in an hour.

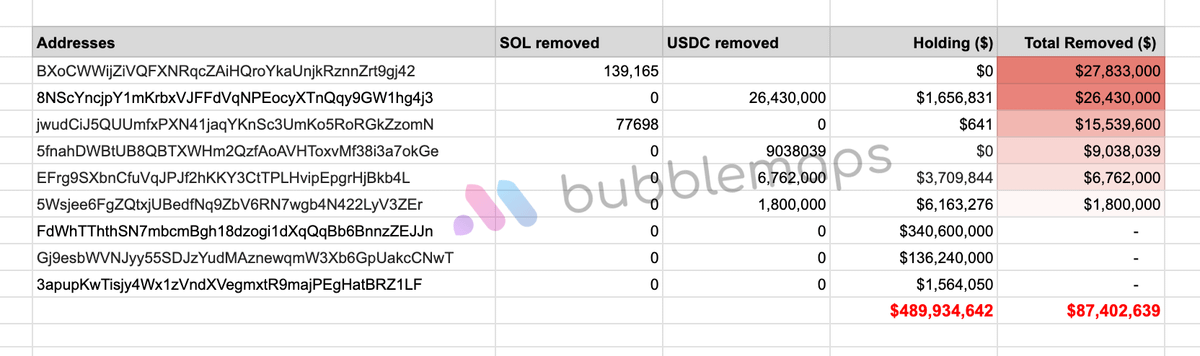

Then, it imploded. Over $87M was pulled from liquidity pools, but instead of selling on the market, the devs were adding one-sided liquidity pools on Meteora with only LIBRA — while removing USDC and SOL.

The token lost more than 95% of its value over time. President Milei quietly deleted his tweet, later issuing a statement admitting he had shared the information without verifying the project’s details.

It all collapsed.

But behind it all was a familiar name: Hayden Davis, a launch strategist, and the suspected architect of several pump-and-dump-style launches. $LIBRA wasn’t his first.

At the bottom of the project’s website, a disclaimer read, “Private Initiative project Developed by KIP Network Inc © 2025”, which linked it to KIP Protocol, a Web3 framework for AI governance, backed by Animoca Brands.

What Happened to $LIBRA’s Liquidity?

The majority of the funds were pulled from liquidity pools during the height of the sell-off and moved across a series of wallets in a pattern designed to obscure origin and control.

Davis initially stated that the funds were being “safeguarded” for redistribution, no clear plan has been provided to date — and a large portion of the original funds remains in wallets under his control.

According to the latest analysis, Davis and connected wallets still hold $93.7M worth of assets, down from a $107M peak, broken down as follows:

USDC Holdings

SOL Holdings

Despite Davis’s public statements, there has been no public disclosure, no audit, and no explanation as to when the funds will be given back to investors.

Political Repercussions For Milei

The $LIBRA collapse triggered immediate political fallout in Argentina, including reports of impeachment calls.

The government responded with two actions:

- The Anti-Corruption Bureau was tasked with investigating any misconduct by national officials, including Milei.

- A new unit under the Presidency, the Unit for Investigation Tasks, was created to examine the $LIBRA project.

No findings have been published so far. But politically, the damage was already done.

Interview Between Hayden Davis and Coffeezilla

Watch it here: the LIBRA interview

To get clarity on the $LIBRA collapse, Coffeezilla conducted a one-hour interview with Hayden Davis.

It was the only public conversation Davis had since the fallout and offers a firsthand look into the decision-making behind the launch and why the funds remain locked in his wallet.

Below are some of the confessions and arguments he made.

Davis Admits to Controlling the $100M

Davis confirmed he pulled the $100M from liquidity pools, claiming it was to “protect the project” from sniper bots and ensure stability ahead of planned marketing pushes.

The plan, according to him, was to re-inject the funds after another round of support from Argentine President Javier Milei. That never happened.

He maintains he hasn’t profited from the event and says the funds are still under his custody.

He insisted, “It’s not a rug. It’s a plan gone miserably wrong.”

Davis claims he was never the deployer or long-term owner of the project.

The responsibility for treasury and post-launch governance, he says, was meant to lie with the KIP protocol — not him.

Internal Sniping Confirmed

Davis admitted that wallets tied to the project sniped $LIBRA at launch by taking early positions before the public could.

His justification was that it was defensive, meant to counteract external bots that typically dump early and damage price action.

He stated that the funds used for these snipes were project treasury, not personal wallets — though tracing those distinctions on-chain is difficult.

Regardless of intent, the sniping gave insiders an unfair entry advantage over retail traders.

Dave Portnoy Was Refunded

Davis confirmed that Dave Portnoy, the American businessman and owner of Barstool Sports, was privately refunded $5M after losing it on $LIBRA.

Portnoy had prior knowledge of the project but claimed he didn’t buy early. Davis said the refund was a mistake, made under the assumption the project would continue growing with Milei’s support.

The refund originated from a wallet later linked to project sniping, which raised further concerns about the blurred lines between personal funds, treasury, and insider coordination.

Milei’s Involvement and Political Reversal

Davis claimed President Milei not only knew about $LIBRA but also supported it as an early experiment in tokenized public finance. According to Davis, there were plans to expand on-chain infrastructure across Argentina using the token as a pilot.

After the crash, Milei deleted his post and cut communication with the team. Davis has received no guidance since, despite holding the $100M.

Four Options Proposed

Davis outlined four paths he’s considering for the remaining funds:

- Donate the funds to a nonprofit in Argentina — unlikely to restore investor confidence.

- Refund investors based on on-chain losses — requires heavy analysis and leaves Davis exposed to backlash if it's imperfect.

- Re-inject liquidity into the chart — his initial plan, but one that would reward insiders again and potentially trigger more trading manipulation.

- Wait for government guidance — no progress on this front.

He initially favored reinjecting the funds to push the market cap back to $2.5-3B, but Coffeezilla pointed out that this would create a new wave of insider opportunities and further hurt credibility.

Davis on Meme Coin Launches

Davis positioned himself as someone trying to solve problems like launching tokens in a market dominated by sniping, alpha leaks, and insider control.

He claimed:

- Every major meme coin is subject to sniper activity.

- Most launches involve insiders to some degree.

- Retail participants are at a structural disadvantage no matter the format.

What We Found After the Interview

While Hayden Davis publicly defended his role in the $LIBRA collapse during his interview with Coffeezilla, our on-chain investigations at Bubblemaps told a different story.

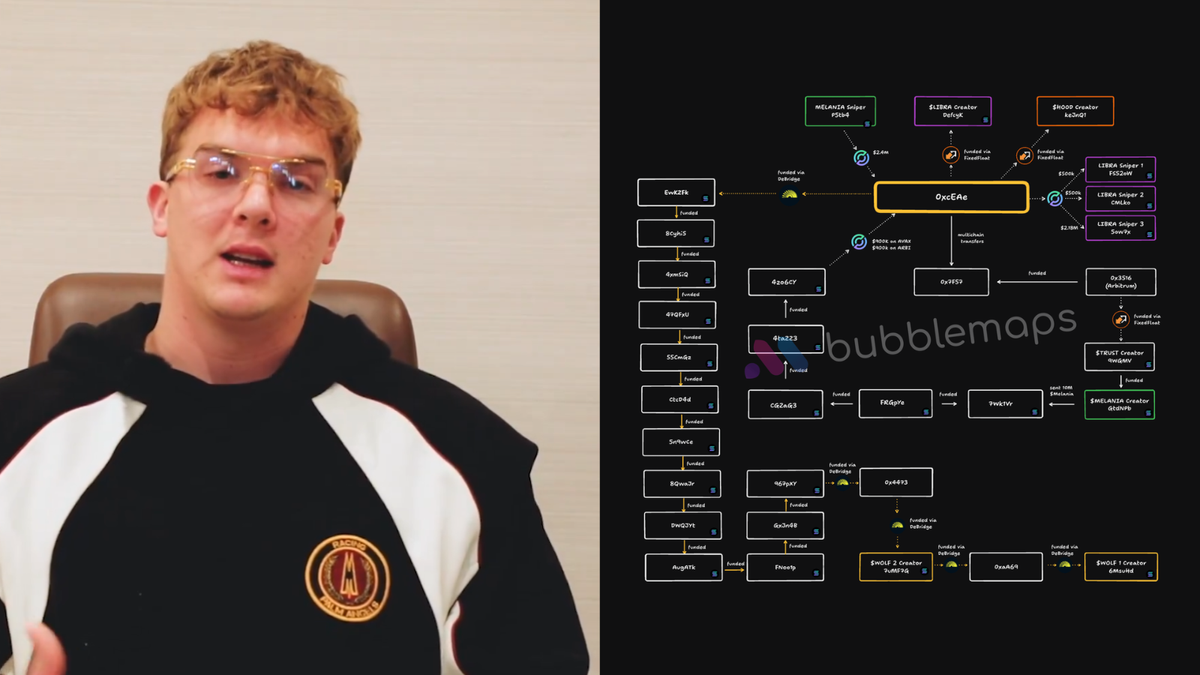

Following the interview, we traced wallet activity across multiple blockchains and uncovered clear evidence tying together $LIBRA, $MELANIA, and several other short-lived meme coins — all pointing back to the same wallet cluster.

Tracing the Wallets

Our investigation began with $MELANIA. A sniper wallet, P5tb4, extracted over $2.4M from the launch.

That wallet then routed its profits to 0xcEA, which we linked directly to the creator of $MELANIA.

0xcEA later funded DEfcyK, the creator of $LIBRA, the same wallet that removed $87M in USDC and SOL from its liquidity pools.

But it didn’t end there:

- 0xcEA also sniped $LIBRA using multiple wallets funded via CCTP.

- That sniping activity alone brought in another $6M in profit.

- Both $MELANIA and $LIBRA followed the same sniper setups, early bundling, liquidity extraction, and near-identical wallet behaviors.

The below chart shows the movement of funds between different wallets, all possibly controlled by Hayden Davis.

Broader Pattern of Rugpulls

We expanded the investigation and found that this wallet cluster wasn’t just tied to MELANIA and LIBRA. We identified similar launch behavior in other tokens, including:

- $TRUST

- $KACY

- $VIBES

- $HOOD

Each showed clear signs of insider pre-funding, tightly bundled supply, and sniper-led price manipulation. Here’s a screenshot of $HOOD below.

He Did It Again: $WOLF

Despite the mounting legal and public pressure, Davis returned with yet another token: $WOLF.

Launched on March 8 and promoted by WallStreetBets, $WOLF reached a $40M market cap before an abrupt crash. As usual, the token’s supply was tightly bundled (82%) and the same sniping pattern reappeared.

We traced the deployer wallet (6MsuHd) through 17 addresses and five cross-chain transfers. All paths led back — once again — to 0xcEA, the same wallet used in MELANIA and LIBRA.

This time, Davis attempted to cover his tracks by pre-funding wallets months in advance and scattering flows across chains. But the pattern didn’t change, and neither did the outcome.

Pattern of Deception

Davis framed himself as a strategist caught in a political and technical disaster. But the data shows repeat behavior of tightly controlled launches, insider sniping, multi-million-dollar extractions, and no clear intent to build sustainable projects.

What began as speculation has now become a documented pattern, visible on-chain. And with every new token, whether it’s $LIBRA, $MELANIA, or $WOLF, the evidence becomes harder to ignore.

What makes this even more serious is that on March 13, Argentinian lawyer Gregorio Dalbón filed for an Interpol Red Notice against Hayden Davis. This makes him an international criminal, not just a rugpuller anymore.

Here’s How to Detect Patterns with Bubblemaps

- Visit Bubblemaps.io: Log in with a Web3 wallet or explore without logging in for a quick overview. (Log in with an email address if you're using V2)

- Search for a Token: Use the search bar to find any token by name, address, or symbol.

- Select the Blockchain: Choose the correct blockchain network (e.g., Ethereum, Base, etc.) to get accurate token mapping.

- Analyze Wallets: View the map of wallet clusters, and click on individual bubbles for wallet details and transaction histories.