From CEX Liquidations to DEX "Liquidations"

Digging in: 📉Market Crashes in Largest Ever Liquidation Event, 🌊What Happened in the Ocean Protocol Conflict, 🤔A 60-Wallet Mysterious Entity Making Millions, and more.

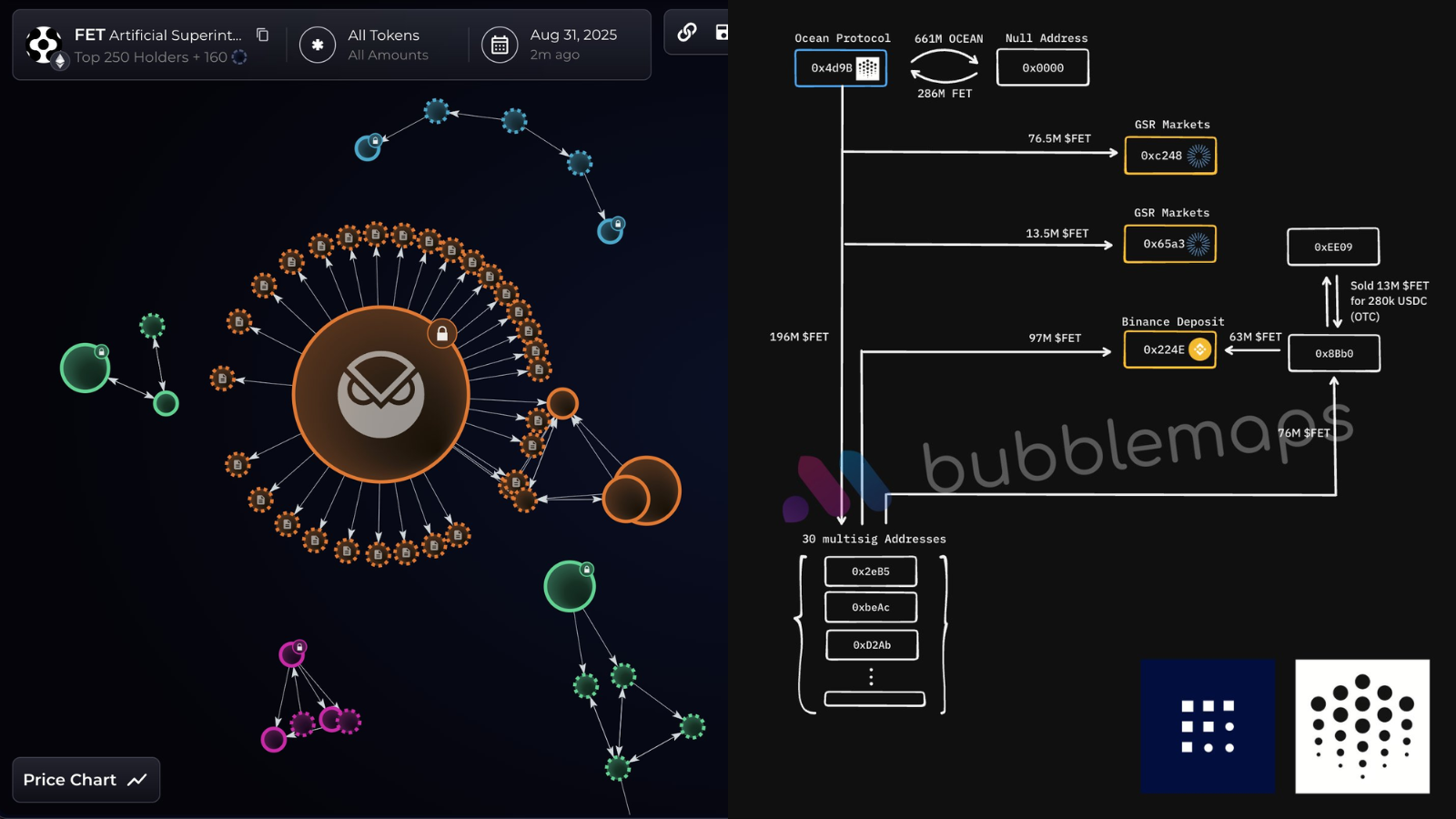

Ocean Protocol: Where Did $100 Million Go?

In March 2024, Ocean Protocol, Fetch AI, and SingularityNET joined forces under the ASI alliance.

Once separate projects, they merged under a single token: $FET. That meant $OCEAN could then be converted to $FET at a fixed rate

Despite the merger, Ocean Protocol team kept a large amount of $OCEAN in their wallets – supposedly for “community incentives” and “data farming”.

However, on July 1st, an Ocean Protocol team wallet (0x4D9B):

> converted 661M of $OCEAN into 286M $FET (~$191M)

> sent 90M $FET to an OTC provider: GSR Markets

On August 31, this team wallet split the remaining 196M $FET across 30 fresh addresses. By October 14, nearly all of them had sent the funds to Binance or an OTC provider. Read our full thread here.

Unpacking the $19B Crash

On the weekend of October 10, we witnessed the worst liquidation event in the history of crypto. An estimated $19B+ in leveraged positions got wiped out in the span of hours. Blame and theories were thrown around, and there is still not a definitive answer to it.

We have gathered multiple opinions and theories related to the event.

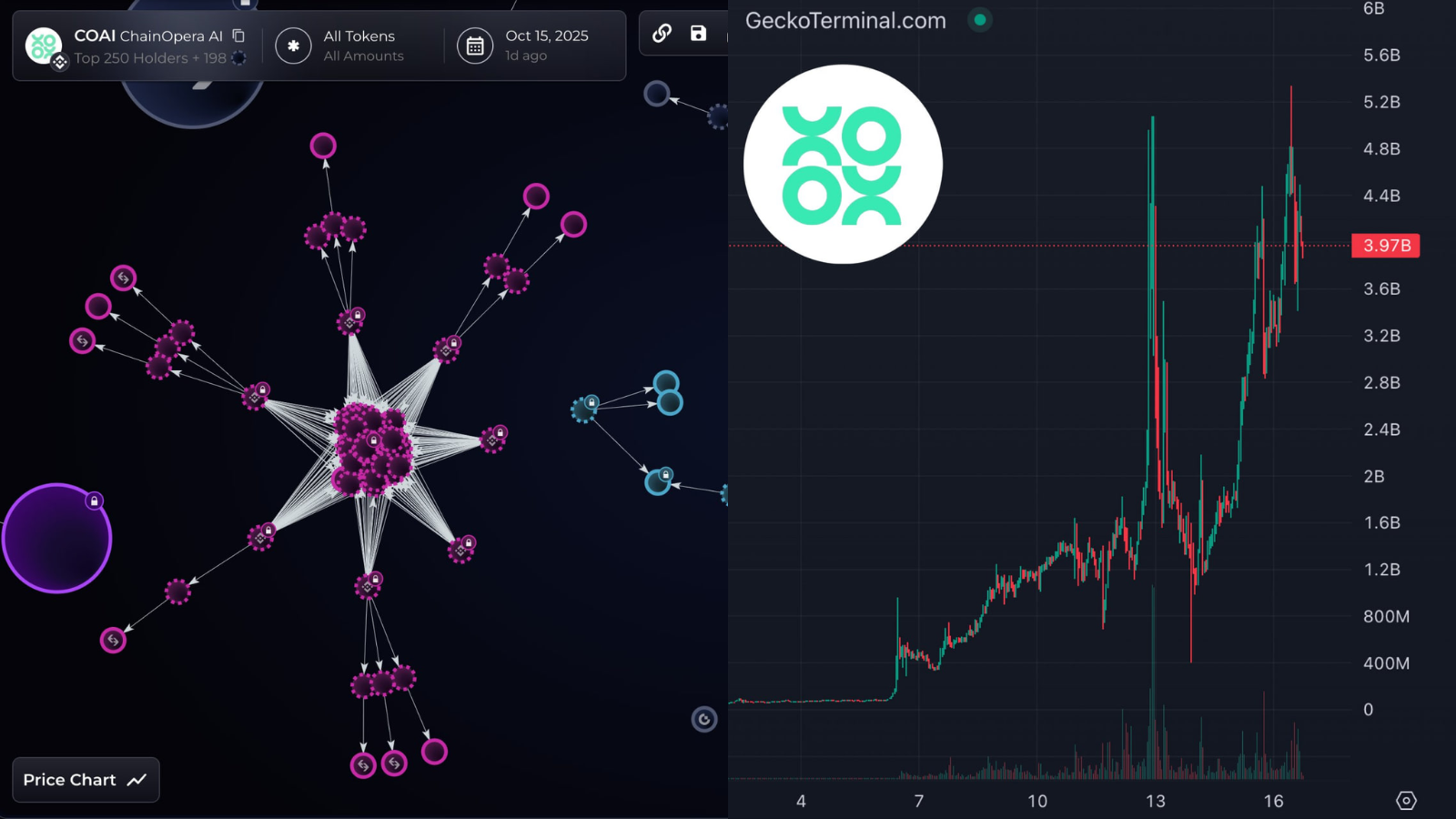

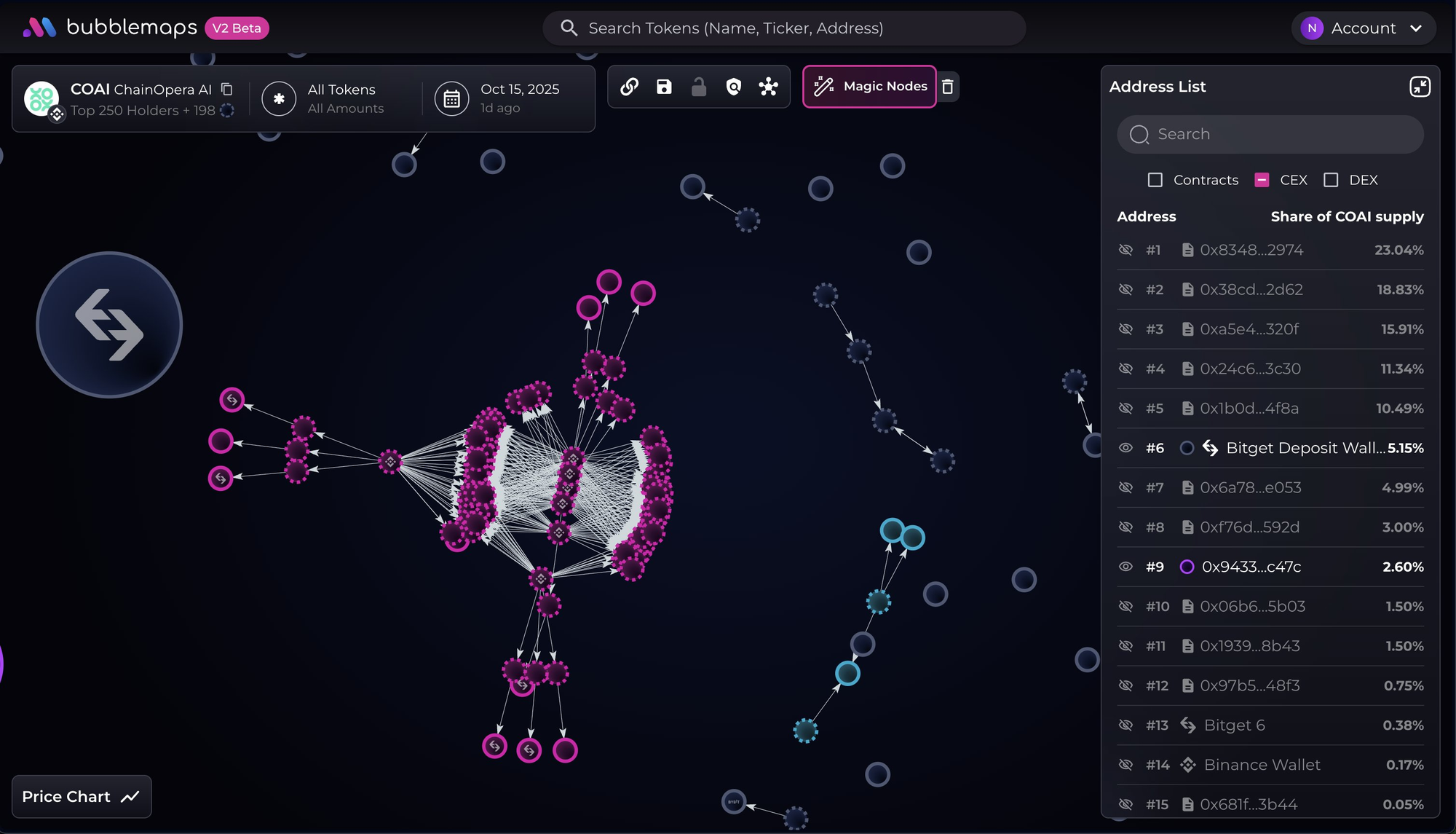

COAI: One Wealthy Entity

One entity controls HALF of the top earning $COAI wallets. Total profit: $13M

ChainOpera is one of the biggest projects on BNB Chain, and according to DappBay:

> 100k users

> $20B FDV

Six months ago, 60 wallets showed common behavior:

> funded from Binance with 1 BNB

> funded on March 25 at ~11am UTC

> all traded on Binance alpha with thousands of automated txs

These 60 wallets are also the most profitable ones. 😳

✨NEW: Website Revamp

We just refreshed our website! What do you think?

Check it out here.